UserIQ

Better understanding users through behavioral archetypes

Overview

An early stage start-up with a small R&D team, UserIQ is a customer success platform offering CS/CX teams the ability to leverage analytical intelligence to understand users by allowing CS teams to create guided product tours, engagement campaigns and track user activity within a product.

TL;DR

Lead the research efforts while also partnering, teaching and mentoring the Jr. designer on my team about research methodologies and best practices.

The challenge

UserIQ had previously targeted two primary user bases; Customer success teams & Product mangers. The company decided to focus in on customer success (CS) as the primary market that the product would cater towards. With this new target market in mind, the UX team was tasked with helping the business better understand the CS user base we currently had.

Our primary reserach goals were:

- Better understand customer success teams currently using the UserIQ product

- Identify notable behaviors, preferences, barriers and technologies that CS professionals use

- Identify any needs and/or opportunities to inform business strategy and product roadmap

The approach

Our general research approach was to start broad and then narrow in as we began to peel back the layers of understanding our users.

We purposefully choose to focus on understanding our users from the perspective of their behavioral usage of the product rather than the traditional persona-based approach. The key reason for this was because although traditional personas have a place in product, given the size and scale of UserIQ, focusing on user behavior made the most sense as we looked to scale the product and shape business strategy.

The research project was broken out into a few key phases:

- In-app user surveys

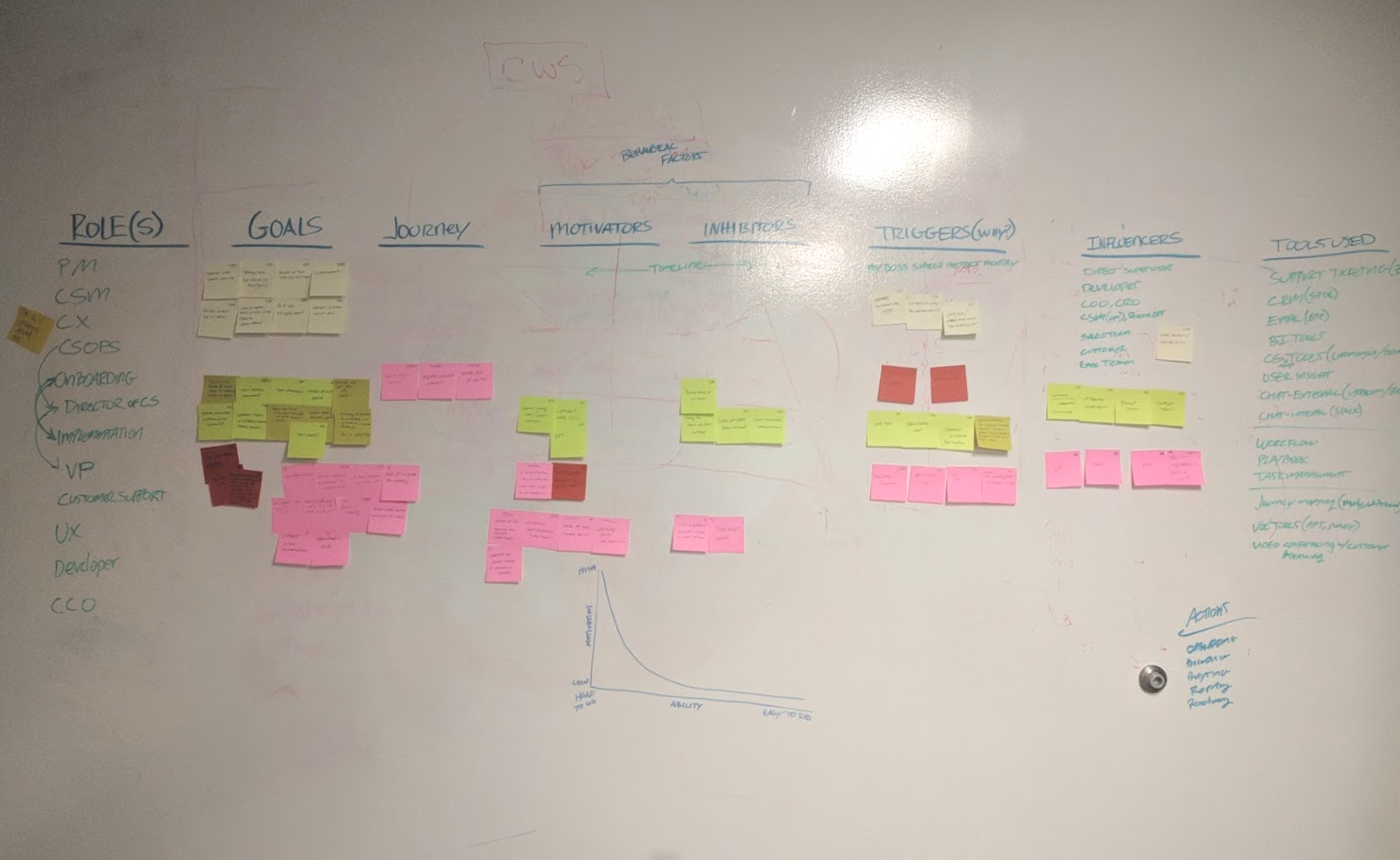

- Document internal tribal knowledge

- On-site user interviews and ethnographies

- Remote user interviews

- UX data distillation

- Affinity mapping of distilled data

On-site customer interviews

Before kicking-off on-site interviews with users, we began with in-product user surveys asking our users for very basic demographic information. Specifically we asked about job roles and titles as well as team size. These surveys were a great way to engage with a large sample size of our users and quickly get a general sense of basic demographic data.

With a base understanding of our users and their roles we then quickly moved to leverage local customers in order to shadow them.

We approached the on-sites with an ethnographic study in mind; observe and document what they do in their day-to-day.

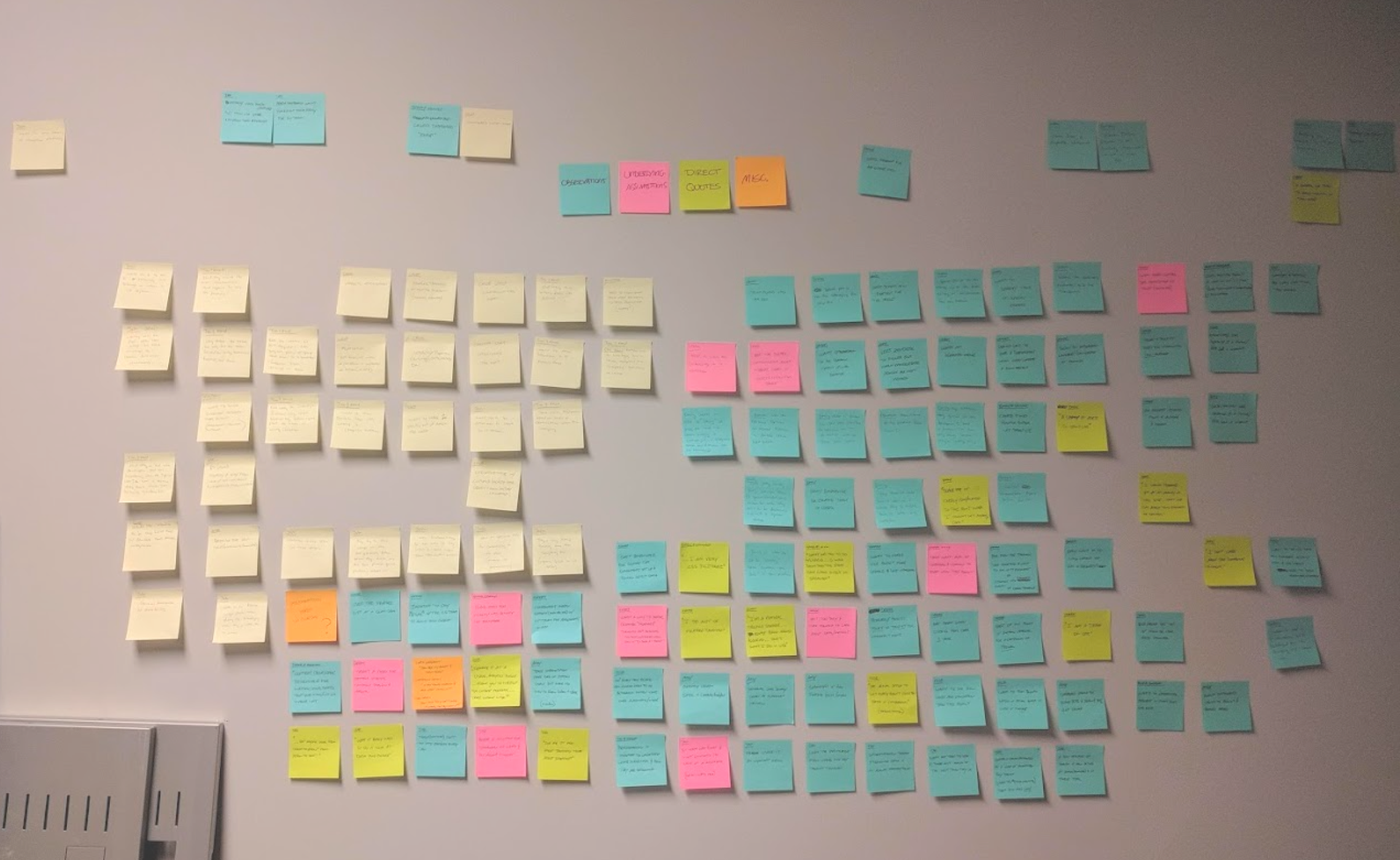

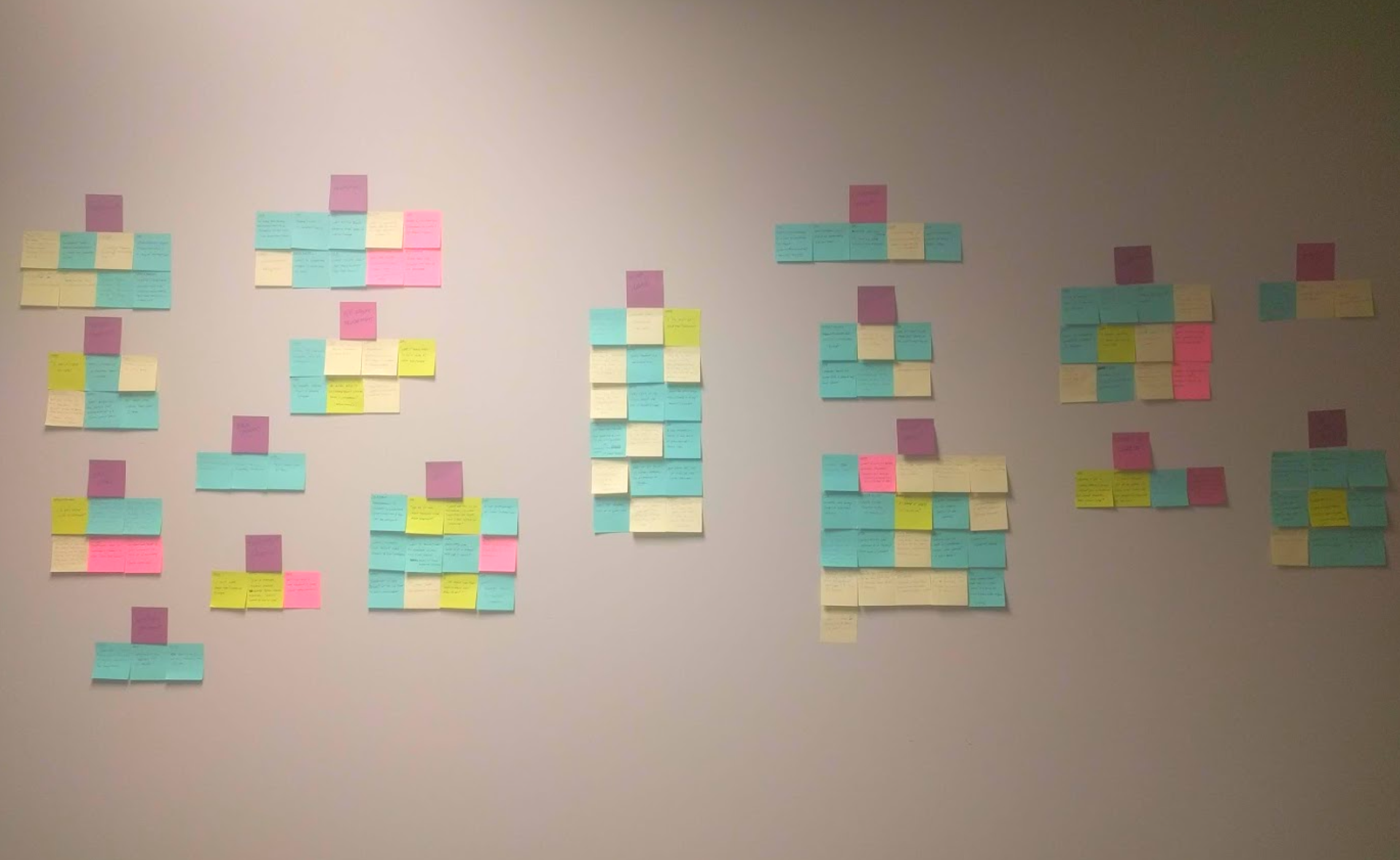

Affinity mapping & organizing the data

With both internal stakeholder and user on-site observation data in hand, we then began the task of making sense of all of this data.

We broke out all data into four categories – observations, assumptions, direct customer quotes, and miscellaneous. Each data point was placed on a color coded post-it note and thrown on a conference room wall.

With everything documented, we then begain affinity grouping all data into similar sub-groups.

The solution

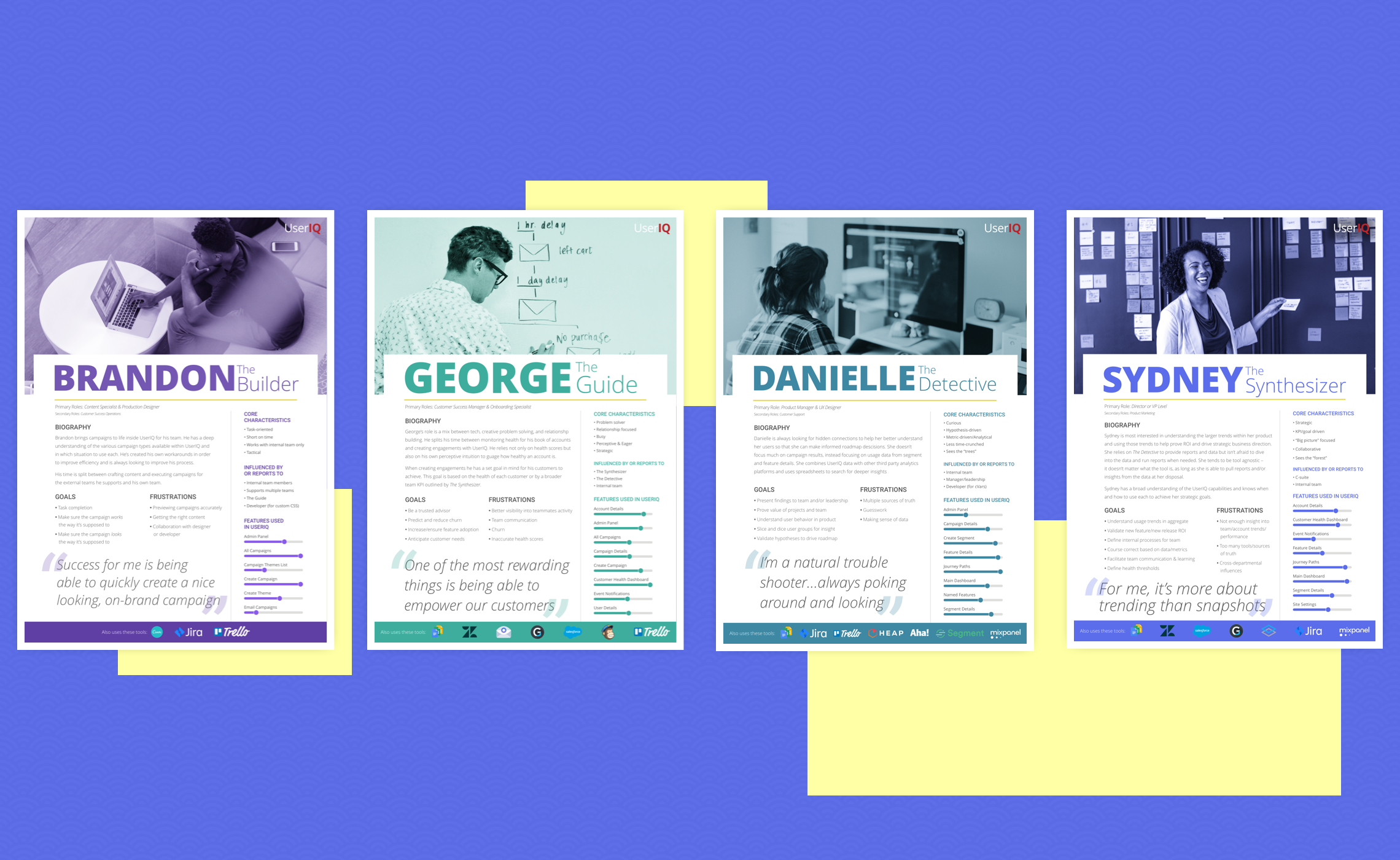

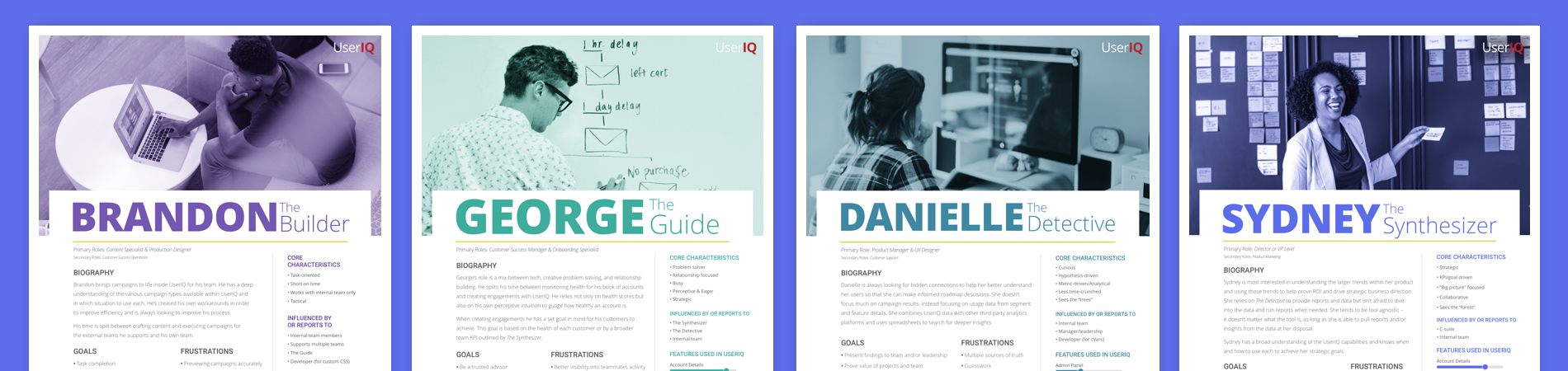

After much distillation we identified four primary user archetypes that the majority of our current user base fell into, we identified commonly used industry products, and identified level of expertise within the product.

The Builder– Users who mostly use the product to create campaigns and then leave.

The Guide– Slightly more involved than The Builders, these users create more strategic campaigns inside the product.

The Detective– Users who like to dig deep into the data to understand usage.

The Synthesizer– Users who use all the learnings within the product to craft business strategy.